Specifically, you should put a checkmark in the “corrected” box on the top of form 1099. This will let the IRS know that the firm has been corrected. Be sure that you don’t include a copy of the original. As long as you put a checkmark in the “corrected” box and include form 1096, the requested changes will be made. Insert the CheckMark 1099 CD-ROM into your computer’s drive. When the CD icon appears on the Desktop, open by double-clicking it, then double-click the CheckMark 1099 installer. Follow the on-screen instructions to complete installation. Export Employee Information into CheckMark Forms 1099 108 To export employee information: 108. Vi Part 3 Processing Your Payroll 111 Steps to Processing a Payroll 111 Chapter 16 Distribute Hours 113 Distribute Hours 113 Modifying a Distribution 114 Undoing a Distribution 114.

Finally, an easy-to-use, affordable, top-notch 1099 Software! Choose from two versions, depending: E-File or Print compatible with Windows® and Mac® operating systems.

Checkmark 1099

CheckMark 1099 program includes 1099-MISC, 1099-INT, 1099-DIV, 1099-R, 1099-S and 1099-NEC forms. When filing forms 1099-MISC & 1099-INT, you may print recipient copies on blank paper. The copies you file with the IRS and state must be on pre-printed forms. For forms; 1099-R, 1099-S & 1099-DIV, print all forms on pre-printed forms. Save time by importing prior year data. Choose the E-file version to file electronically via the IRS’s FIRE system (requires prior registration with the IRS).

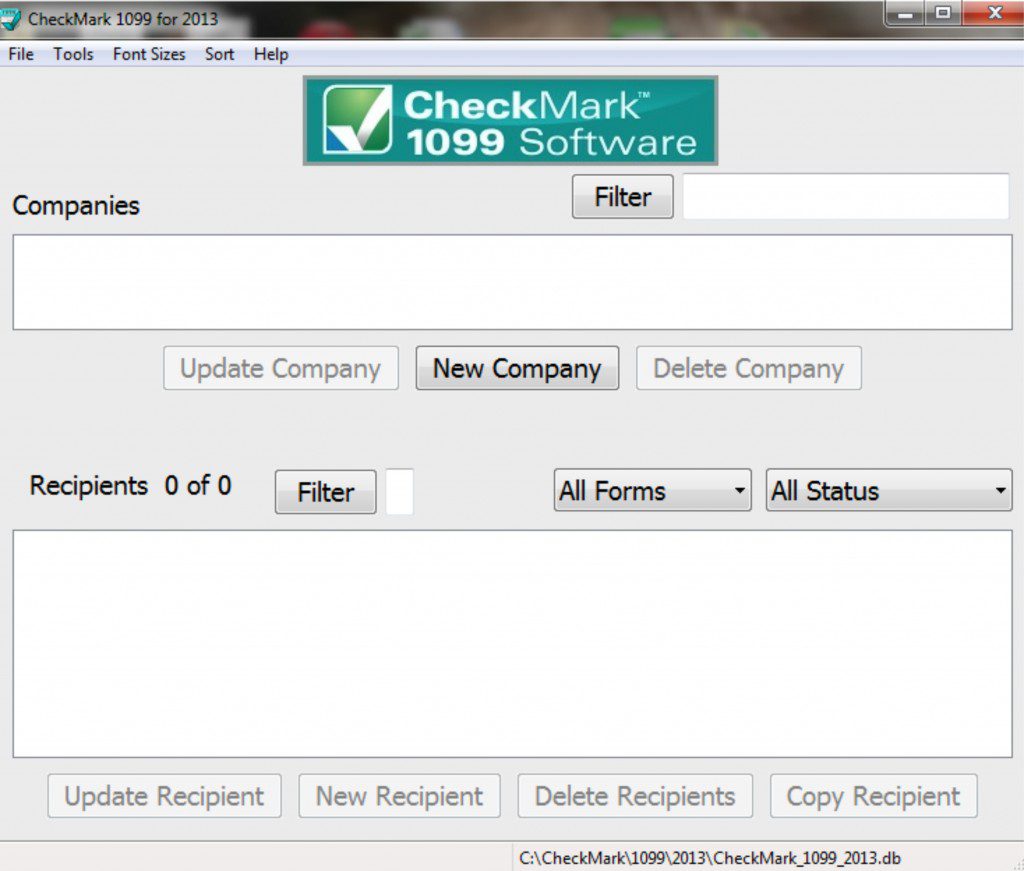

Enter your information in screens designed to look like the real forms 1099 and eliminate mistakes. Our program is specifically designed to handle unlimited companies and unlimited recipients.

Before you can E-File, you must submit Form 4419 (Application for Filing Information Returns Electronically) and receive approval from the IRS. For more information visit www.irs.gov/pub/irs-pdf/f4419.pdf

1099 Form Program

*Please note: The IRS may take up to 45 days to approve your application and you need to create an account on the IRS’s FIRE system in order to submit your filings.